Author

- Hannah Maniates

Focus Areas

Program Stream

What is Medicaid managed care?

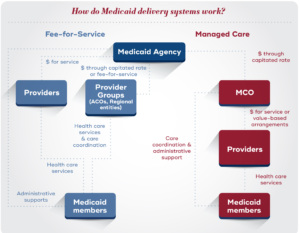

Medicaid is one of the United States’ largest health insurance programs, providing care for almost 90 million people as of August 2023. Although Medicaid is often understood as safety net coverage for low-income people, its reach extends far more broadly. Today, Medicaid covers low-income families, children with complex health needs, pregnant women, older adults, people with disabilities, and low-income single adults. Like other insurers, Medicaid agencies don’t deliver health care services directly; instead, they must develop a “delivery system” to pay health care providers for covered services received by Medicaid members. The two main delivery system models are fee-for-service, where the Medicaid agency directly pays providers or groups of providers, and capitated managed care, where the Medicaid agency pays an external managed care organization, who then pays providers for covered services. Currently, the overwhelming majority of states use a capitated managed care model to deliver at least some of their Medicaid benefits, with approximately 72 percent of Medicaid members enrolled in comprehensive managed care as of 2021.

Under comprehensive capitated managed care, the state or territory pays the managed care organization (MCO) a monthly capitation rate for each Medicaid member enrolled in the plan. In exchange for this “per member per month” rate, the MCO must handle a range of functions, including developing a provider network, paying providers forcovered services received by their enrollees, setting utilization management standards like prior authorization, and engaging with enrollees to coordinate care. These functions are defined in the contract between the MCO and the Medicaid agency. Although the “per member per month” rate is intended to cover the needs of the member, capitated managed care is a risk model; the MCO may lose money if the cost of services and program administration is more than the monthly capitation rate or may make a profit if the cost of services and program administration is less than the monthly capitation rate.

Under fee-for-service, the Medicaid agency typically manages these functions independently, paying providers or groups of providers directly for services delivered to Medicaid members. However, in recent years, many states have taken up strategies to manage care for fee-for-service members, including through the development of accountable care organizations and regional entities. Under these models, groups of providers coordinate treatment and may take on financial risk for a patient population.

Per federal regulations, comprehensive managed care contracts must cover an array of medical benefits. States and territories can, however, choose to “carve out” specific benefits – like behavioral health services, dental, or pharmacy benefits – into limited benefit plans or into fee-for-service. They may also target plans to specific populations, such as plans for foster care youth or managed long term services and supports. Because states and territories are given considerable flexibility around the design of their delivery systems, there is substantial variation across Medicaid agencies in the number of managed care plans, the percent of members who are enrolled in a managed care plan, and which benefits are delivered via managed care.

How has managed care grown over time?

As of July 2022, 41 states had some form of comprehensive managed care, representing over half of total Medicaid spending. How did managed care become the predominant delivery model?

Although pre-paid health plans date back to the early 1900s, modern health maintenance organizations (HMOs) were spurred by the Health Maintenance Organization Act of 1973, which established federal requirements for HMOs, allocated federal funding to test HMOs as an alternative to fee-for-service, and required employers to offer coverage through a federally-qualified HMO. In the HMO Amendments of 1976, Congress established the “50/50” rule, which stated that Medicaid agencies could only contract with federally qualified HMOs who had no more than 50 percent of their members enrolled in Medicaid or Medicare. This provision was intended as a safeguard against misleading marketing and fraud from MCOs. This threshold was increased to 75 percent in the Omnibus Budget Reconciliation Act of 1981 and eliminated with the Balanced Budget Act of 1997, which facilitated proliferation of Medicaid managed care.

Over time, Congress also established requirements for how Medicaid agencies work with managed care organizations. Section 1932 of the Social Security Act sets guardrails around how Medicaid managed care plans operate, including requirements around choice of coverage, processes for enrolling in plans, notices, member protections, and provider networks. Section 1932 also requires Medicaid agencies to conduct certain oversight activities of managed care plans, including developing a quality assessment and improvement strategy and providing for an annual external quality review.

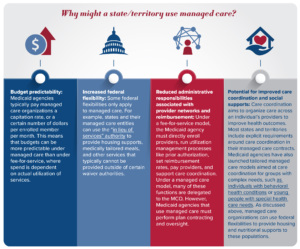

In response to this changing federal landscape, many states and territories have moved towards managed care delivery models. As discussed in the next section, a range of factors have fueled interest in managed care, including a desire for budget predictability, enhanced federal flexibilities, and the potential for improved care coordination. There are, however, open questions around the impact of managed care on quality and access.

HOW DO STATES AND TERRITORIES MAKE DECISIONS AROUND DELIVERY SYSTEMS?

Why might a state/territory choose to use managed care to deliver Medicaid services, instead of a fee-for-service model? Switching to a managed care model (or switching from managed care back to fee-for-service) has substantial impacts on budget and service delivery. Because of this, state legislatures and governors are almost always involved in decisions around delivery system models, and Medicaid agencies often implement managed care at the direction of their state legislatures.

Many proponents of managed care cite improvements in access and quality as potential benefits. Interestingly, the academic research on outcomes associated with managed care models is mixed; some studies have found improved quality and access under managed care models, while other studies have found no impact or worse outcomes. There is also continued debate over if managed care organizations are best positioned to provide care coordination, or if provider entities such as ACOs are more effective.

WHAT ARE THE CORE COMPONENTS OF OPERATIONALIZING MANAGED CARE?

Procurement

Medicaid agencies contract with managed care organizations to provide certain benefits and services. These contracts last for at least three to five years, impact care for millions of Medicaid members, and can be worth billions of dollars. Because of the stakes of these contracts, Medicaid agencies have developed robust processes to ensure they are selecting MCOs who will deliver high-quality care.

Most states use a competitive procurement process to contract with MCOs. This means that the state will release a request for proposals (RFP) with specific requirements and interested MCOs submit proposals. The state/territory then uses a rigorous process to score these proposals and award the managed care contract. The number of contracted MCOs varies across states and territories; in 2019, some states only had one MCO contract while others had up to 25 contracts.

States and territories use the procurement process to set their goals for the Medicaid delivery system and select health plan partners who can advance those goals. For example, a Medicaid agency may choose to include contract requirements (such as new covered services, quality initiatives, or member engagement strategies) based on their broader program goals. The agency may also include certain questions, case scenarios, scoring frameworks, and requests for previous performance data (e.g., HEDIS metrics, history of corrective action plans, etc.) to determine which MCO is best able to support the agency’s goals (such as quality, value-based purchasing, or integration for dually eligible members). Ultimately, the MCO contracts that result from this procurement process drive how Medicaid members experience care, including the services they can receive, the providers they can go to, and how their care is administered.

What does a procurement process entail?

The entire procurement process typically lasts between 18-24 months, which includes preplanning, the active bidding process, and implementation of the new contract. There are many stages in this process, including:

- Information gathering to define vision and goals: A Medicaid agency’s vision for the delivery system drives the managed care procurement process. Defining this vision often requires input from key partners like Medicaid members, providers, and community-based organizations. Collecting this information through town halls, requests for information, and stakeholder meetings can take several months.

- Translating this vision into a request for proposals: Next, the state or territory must translate these goals into a formal request for proposals (RFP). In the RFP, the Medicaid agency will define contract requirements and oversight mechanisms, and ask for information on the MCO’s programs and operations. Interested plans “bid” on these RFPs.

- Establishing procedural standards to mitigate against protests: Formal protests can expend significant state resources and delay managed care implementation. Medicaid agencies often work with their legal counsel to define strategies to minimize the risk of formal protests, including standardized evaluation processes.

- Scoring proposals and awarding the contract: After receiving proposals from interested MCOs, the state or territory evaluates the bids based off pre-determined criteria. Many Medicaid agencies use formal scoring rubrics to ensure a fair and standardized process. The contract is awarded based off the results of these evaluations.

- Contract execution, readiness review, and implementation: After an MCO is selected, the state/territory must translate the plan’s proposal into a formal contract that codifies the benefits and services the plan will provide. Then, the Medicaid agency and MCO move into the implementation stage, which includes establishing systems and reporting structures to ensure the MCO meets their contract requirements, aligning IT systems to support member enrollment, and conducting readiness reviews. Readiness reviews typically occur several months before the “go-live” date for the plan to ensure a smooth implementation.

Rate Setting

Under capitated managed care, Medicaid agencies pay MCOs a “per member per month” rate. In exchange for this rate, the MCO provides the services and administrative benefits outlined in the contract; effectively, this shifts risk associated with unpredictable costs from the Medicaid agency to the MCO. Every twelve months, each Medicaid agency and its actuary must develop these rates and have them certified by CMS.

Federal regulations require that these rates be actuarially sound, which is defined as rates that are “projected to provide for all reasonable, appropriate, and attainable costs” that are required by the contract for the time period and population covered. Medicaid agencies and their actuaries also have to meet certain regulatory requirements around how they develop and document their rates.

It is inherently difficult to predict the actual cost of services in a given year. What if Medicaid members use services more or less than expected, or what if a new high-cost treatment (like the GLP-1 diabetes and weight loss drugs) enters the market? To help reduce the risk associated with setting rates too high or too low, Medicaid agencies can use fiscal tools like medical loss ratios and risk corridors. Medical loss ratios represent the proportion of the total capitation rate revenue that the plan spends on services or quality improvement activities (and not on profit, advertising, or other administrative functions); if the plan doesn’t meet the MLR, the state can require the plan to pay back some portion of their revenue. Similarly, risk corridors allow the Medicaid agency and MCO to split savings or losses beyond certain thresholds specified in the contract.

Oversight

Oversight is a crucial component of how Medicaid agencies work with managed care organizations. Managed care organizations have their own set of incentives and stakeholders, including profit targets, investors, and boards. Strong oversight helps ensure that plans are acting in alignment with Medicaid agencies’ goals around access and quality.

Oversight processes are built into a Medicaid agency’s contract with their managed care plans. Contracts specify how Medicaid agencies expect managed care organizations to deliver services, and enforcement mechanisms if managed care organizations fail to meet these expectations. Medicaid agencies monitor data including access standards (such as provider networks and appointment wait times), complaints and grievances from members and providers, and encounter data to identify areas where managed care organizations may not be complying with contract requirements. The federal government has also established certain requirements for how states/territories oversee their managed care plans. Medicaid agencies are required to develop an annually-updated quality strategy, complete the managed care program annual report (MCPAR) which includes quality measures and grievance and appeal data, and facilitate annual quality reviews by external organizations.

Medicaid agencies use a variety of penalties and incentives to ensure compliance with managed care contracts. If an MCO is not compliant with their contract, the state may use formal enforcement mechanisms like corrective action plans, monetary penalties, and enrollment restrictions. Many Medicaid agencies also use strategies like withholding part of the capitation rate unless the plan meets certain quality targets, publishing data on plan performance publicly, and creating fiscal or enrollment incentives for performance to encourage certain outcomes. Together, these oversight strategies help Medicaid agencies ensure that their managed care organizations are delivering high-quality care to their members.

HOW IS MEDICAID MANAGED CARE CONTINUING TO EVOLVE?

Medicaid managed care has grown dramatically over the past two decades, with over 70 percent of Medicaid members currently enrolled in MCOs. How might managed care continue to evolve?

First, Medicaid agencies’ choices and priorities around delivery systems are continuing to change. Over recent years, some Medicaid agencies have carved services like behavioral health care and pharmacy benefits into managed care or back into fee-for-service. Many states have also explored targeted plans for specific patient populations, such as former foster care youth or individuals with intellectual disabilities. Notably, there has been significant growth in managed long-term services and supports, with an increase in spend from $6.7 billion in FY2008 to $47.5 billion in FY2019. In addition, Medicaid programs are increasingly looking to their plans to address health-related social needs and reduce disparities in care and outcomes. These changes have real impacts on how, where, and which care Medicaid members receive.

Market dynamics may also impact managed care. Over the past several years, there has been a wave of consolidation in the managed care market; currently, five managed care companies account for 50 percent of national Medicaid MCO enrollment. Although there is a dearth of research on the impacts of managed care consolidation in Medicaid, research from other insurance markets suggests that consolidation may have impacts on health care prices, quality of care, patient access, provider wages, and overall health care spending.

Finally, the regulatory landscape around managed care is continuing to change. In April 2023, CMS issued a proposed rule on Medicaid managed care. The rule would create significant new requirements for Medicaid agencies and managed care organizations, including new access standards, quality assessments, and payment analyses, and would make changes to fiscal tools like state-directed payments and in lieu of services. Separately, the Health and Human Services Office of Inspector General has launched work focused on prior authorization and other utilization management criteria in Medicaid managed care. At the state level, there has also been a wave of innovation around managed care oversight strategies, including an emphasis on strategies to reduce health disparities. Together, these changes indicate an increased focus on ensuring that MCOs deliver high-quality and accessible care to Medicaid members.

Medicaid delivery systems are complex, varying across states and territories, patient populations, and service types. The choices that Medicaid agencies make around delivery systems, including choices around the use of capitated managed care, have real impacts on how Medicaid members experience care. As Medicaid managed care continues to evolve, it will be important to understand its impact on health care quality, access, and cost.

This resource was developed with support from The Commonwealth Fund, a national, private foundation based in New York City that supports independent research on health care issues and makes grants to improve health care practice and policy. The views presented here are those of the author and not necessarily those of The Commonwealth Fund, its directors, officers, or staff.

Want more like this?

Related resources

Medicaid Leader’s Playbook for Building Public Health Partnerships

How Medicaid Provider Taxes Work: An Explainer

Stay Informed

Drop us your email and we’ll keep you up-to-date on Medicaid issues.