How Medicaid Provider Taxes Work: An Explainer

This resource explains how Medicaid provider taxes work, why states use them, and the key changes made under OBBBA, providing context for the provider tax provisions highlighted in NAMD’s OBBBA Medicaid Policy Timeline.

Author

- Hannah Kim

Focus Areas

Program Stream

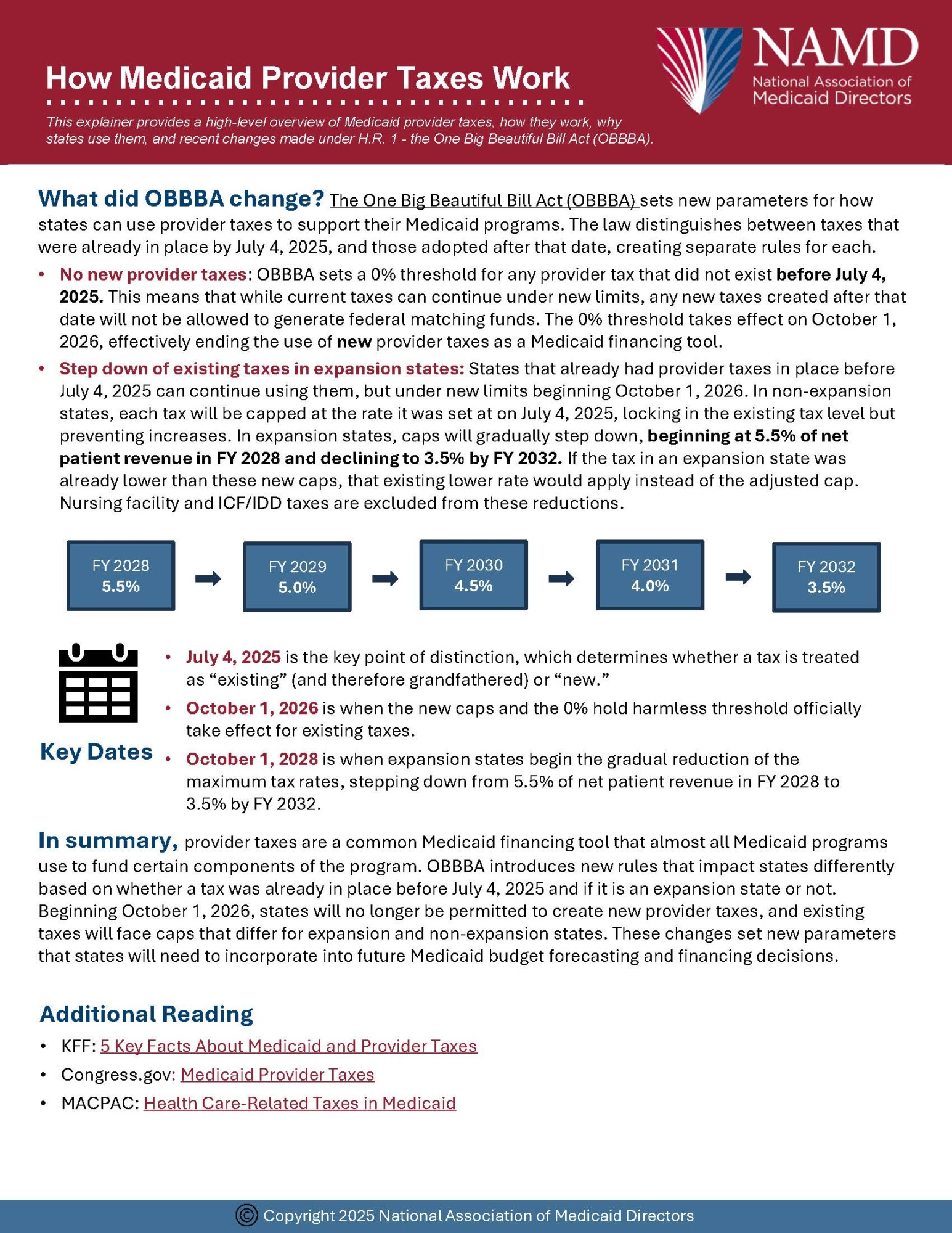

This explainer offers a concise overview of how Medicaid provider taxes work, why states use them, and the changes made under the One Big Beautiful Bill Act (OBBBA). Created as a companion to NAMD’s OBBBA Medicaid Policy Timeline, this resource gives readers a clear understanding of a complex Medicaid financing tool and highlights key dates and parameters established by OBBBA. While not an exhaustive guide to every financing provision in the law, it provides essential context for anyone seeking to understand how provider taxes fit into Medicaid funding and how recent federal policy changes will shape state planning. Click here to download the PDF.

Related resources

Building Better Medicaid Partnerships

Q&A with Jen Strohecker: Leading Through Crisis and Closing Cracks in Care

Stay Informed

Drop us your email and we’ll keep you up-to-date on Medicaid issues.